The car shopping process isn't exactly known for its transparency. Between the price fluctuations of used cars and the hidden fees of new cars, predicting your total costs is difficult, if not impossible. Add in the uncertainty of auto loan approval and interest rates to the equation, and you may feel like you're getting the wool pulled over your eyes. Although there's not much you can do about the variance of vehicle prices, you can take control of your auto financing. We'll help you pull that wool off your eyes and understand what goes into your auto loan approval process and how to tackle it successfully.

Car Loan Pre-Approval

Some car shoppers put all their time into researching vehicles and comparing specs and pricing of various makes and models. With all the work they put into researching the car itself, these shoppers often don't put in the same effort when it comes to financing their vehicle. They simply go into the dealership's F&I (Finance and Insurance) office after picking out their vehicle and accept the first car loan offer they get. This may be ok for shoppers with very good credit, but anyone with a credit score that doesn't fall under the "excellent" category will benefit from shopping around and comparing auto loans before going in to buy the car. Auto loan pre-approval will give you the chance to do just that.

Why Get Pre-Approved?

Getting pre-approved for your auto loan has many benefits, that are especially crucial for car buyers without excellent credit. Pre-approval lets you compare interest rate offers to choose the most cost-effective one. If you go in unprepared, you can end up paying significantly more in interest or you may be denied an auto loan entirely. Over the lifetime of your loan, a better interest rate can potentially save you thousands of dollars. Pre-approval gives you several options for interest rates and lenders, and as a bonus, it can make the dealership experience faster and smoother.

Where to Get Pre-Approved

You can get pre-approved through a bank, credit union, or online lender. Here at Web2Carz, we work with a nationwide network of auto finance partners to help car shoppers find the best auto loan rates for their needs and you’ll be able to get pre-approved for either a new car or used car. To make comparing auto loan offers easier, you can use a template offered by the Federal Trade Commission which lets you fill in variables like the negotiated price of the car, down payment, APR, length of contract and more.

Impact on Your Credit Score

You may be thinking "how will my credit score react to car loan pre-approval?" You can expect a slight ding to your score when lenders pull your credit, but the good news is that you can avoid a substantial drop by applying for multiple pre-approvals within a short timeframe which counts as one inquiry. According to NerdWallet, you'll want to apply for all pre-approvals within a 14-day period to reduce the impact on your credit score.

Get Pre-Approved for a Car Loan Today

Dealership Financing

If your credit is good or if your car purchase is an emergency and you don't have time for shopping around for car loan offers, you can finance the vehicle at the dealership's F&I office. If this is the route you take, you'll get the convenience of a one-stop shopping experience, but with the tradeoff of not being able to cross-shop auto loan offers. Even if you don't have the time to get pre-approved, you should still prepare by obtaining a copy of your credit report before heading into the dealership. This way, if you're offered an interest rate that seems unfairly high, you can leverage this information to negotiate.

In addition to financing the car itself, be aware that the F&I manager will offer many extras including gap insurance, extended warranties, and paint and fabric protection, all of which can be rolled up into the auto loan. Although the monthly payment may not seem to increase by a large amount when the extras are factored in, beware that the overall costs can climb into the thousands.

Auto Loan Requirements at the Dealership

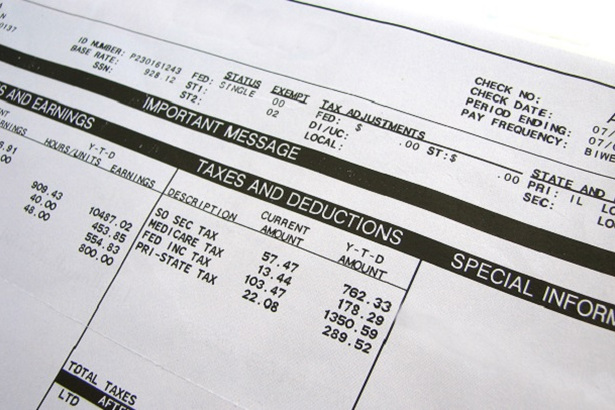

To ensure your car buying process doesn't hit any speed bumps, remember to bring the necessary documents to the dealership. For the auto financing step, make sure you're ready to submit the following information:

- Social Security

- Current and previous address(es) and length of stay

- Current and previous employer(s) and length of employment

- Occupation

- Sources of income

- Total gross monthly income

- Financial information on current credit accounts, including debt obligations

What Factors Impact your Car Loan?

What exactly determines auto loan approval (or denial) is often a source of mystery for the car shopper. Some buyers believe their credit score is the only determining factor, but there are other financial variables in the mix. The main factors that will impact your car loan approval and interest rate include your credit score, debt-to-income ratio, down payment, length of the loan, and vehicle age.

Credit Score

FICO credit score categories include: very poor, fair, good, very good, and exceptional. Having "good" credit or better means you'll most likely get approved for an auto loan and you'll pay less in interest which can significantly reduce the overall cost of the loan. Having "poor" credit will make it more difficult to get a loan. Some lenders can work with you even if you have bad credit, but you should go in expecting a higher interest rate.

Debt-to-Income Ratio

Your debt-to-income ratio is your overall debt compared to your income. If your debt-to-income ratio is high, your interest rates will likely climb even if your income is high. Having a significant down payment will improve your chances of getting approved, even with a lower credit score or high debt-to-income ratio because it reduces the total amount of the loan and the risk for the lender.

Car Loan Length and Age of Vehicle

The length of the auto loan and the age of the vehicle you're buying both affect the auto loan offers you receive. The longer you stretch out your auto loan, the higher you can expect your interest rates to climb. Even though the average auto loan has increased to 6 years, it'll be in your best interest (literally) to keep it to 5 years or under. Financing a new car will usually yield a lower interest rate than a used vehicle because the lender gets a higher resale value from a new car than from used in the event of repossession which mitigates their risk.

Now that you know how to prepare to finance your vehicle before heading to the dealership, what you can expect at the F&I office, and how auto loan approval and interest rates are determined, you can go research and buy your car with confidence.