Some aspects of car shopping are exciting (e.g., reading car reviews and test driving), and then there's auto financing. Financing a vehicle can be an intimidating process for any car shopper as they navigate interest rates and monthly payments. Shoppers with compromised credit face even more uncertainty due to higher interest rates and the risk of loan denial. This group should understand the minimum requirements to get a car loan including credit score range, monthly income, down payment, and alternative options. Preparation reduces the stress of auto financing for a more enjoyable car shopping experience.

Minimum Credit Score for a Car Loan

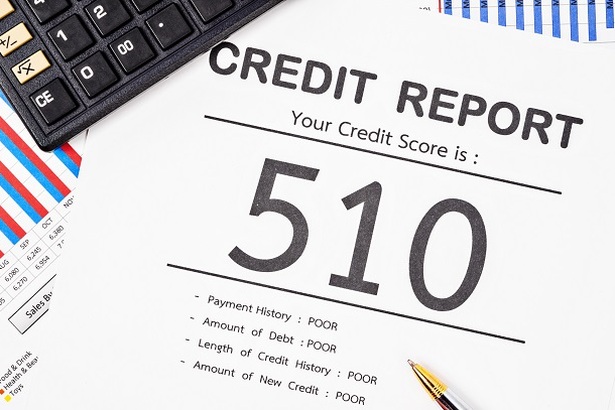

A car buyer's credit score makes the largest impact on a lender's decision to approve a car loan and the interest rates available (the lower the score, the higher the interest rates). Even if you've been working to repair your credit, past mistakes like missed payments can come back to haunt you. You're probably wondering "so, what is the minimum score for auto loan approval?" Although there is no official "minimum credit score" that determines car loan approval or rejection, thinking about the credit score in terms of categories is a good approach.

FICO is the most widely used credit rating among lenders and it divides consumer credit ratings into five categories including very poor, fair, good, very good, and exceptional. About 16% of the U.S. population has a "poor" score between 300-579 which puts them at risk of not getting approved for a car loan at all. 17% of the population has a "fair" score between 580 and 669 which is considered subprime and results in higher interest rates. 67% of car shoppers fall into the "good" to "excellent" range with scores between 670-850.

For the best chance of being approved for a car loan, you'll want a minimum credit score that is in the "fair" range or higher (580+). Although credit scores play a large role in auto loan approval, it doesn't mean all bets are off for car shoppers with bad credit. Meeting some of the following requirements can help you get the auto financing you need.

Apply For a Bad Credit Car Loan

Minimum Income Requirements

If your credit score doesn't fall into the "good" range, auto lenders will look for a minimum income to issue an auto loan. These minimum income requirements will vary by lender, so just as with credit score, there is no hard minimum for auto loan approval. According to Auto Credit Express, subprime auto lenders usually look for a monthly pre-tax amount of $1,500 to $2,000 from a single source of income. This means the minimum income must come from one employer, and multiple incomes can’t be combined to meet the minimum requirement.

The monthly income isn't the only factor considered by auto lenders. Before approving your car loan, lenders look at how long you’ve been employed at your job. In some cases, just your current income will be evaluated. If there is any doubt about your ability to repay the loan, lenders may look at the past 24 months to determine your job stability. Steady employment with consistent income will look favorable compared to sporadic employment where your income fluctuates or disappears completely.

Proof of Income

If you didn't get pre-approved for your car loan and have compromised credit, proof of income in the form of pay stubs, bank statements, or your W-2 may be required to get financing at the dealership. If you recently moved to the state where you're buying a car, it is even more important to bring these documents.

Minimum Down Payment

When financing a car, it is recommended to put some money down at purchase. The recommended amount is at least 20% of a new car purchase and 10% for a used car. In addition to reducing the interest rate, you'll pay less over the lifetime of the loan and enjoy a lower monthly car payment.

For car shoppers with bad credit, a down payment can mean the difference between auto loan approval and rejection. A substantial down payment gives auto lenders confidence that the borrower has the financial stability to repay the loan. If you're looking to buy a used car for $15,000, shoot for at least a $1,500 down payment. It can work to your advantage to hold off on buying a car until you have enough saved up for the minimum down payment.

Alternative Options

Car shoppers with bad credit who don't meet the above requirements can take several alternate routes if a car purchase can't be delayed. Enlisting a cosigner with good credit gives lenders a backup source of payment and greater confidence to approve the auto loan.

Alternative lender options including credit unions, buy-here-pay-here dealers, and online subprime lenders are more flexible to approve borrowers with bad credit, albeit with higher interest rates. Applying for auto loan pre-approval from several types of lenders gives you the opportunity to compare APR rates and choose the best offer. Finally, saving up and paying cash for an affordable used car can be a good solution to skip the car loan process altogether.