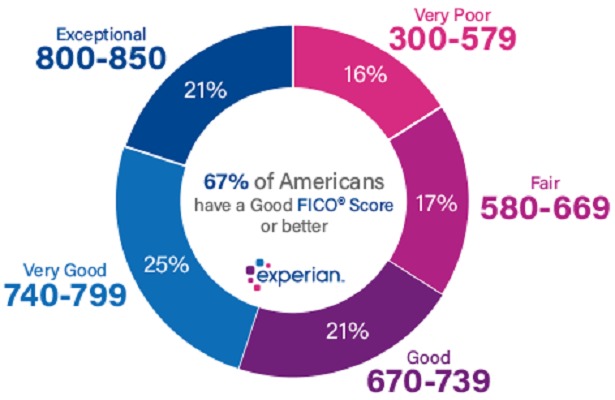

If you’ve ever financed a car, you know the impact your credit score has on getting the vehicle you want. Car shoppers with good or excellent credit don't have to hunt for a car loan with a low interest rate, but this group only accounts for 67% of consumers. The rest of the population with a fair or poor credit score often struggles with double-digit interest rates or rejection for a car loan entirely. A credit score measures a consumer’s ability to handle and repay debt and is the largest component of the auto financing approval process. See how average credit scores vary by location, age, and income and get tips to boost your score.

Average FICO and Vantage Credit Scores

According to NerdWallet, the two major credit scores (FICO and VantageScore) rate consumers' credit histories using a range between 300 and 850. In 2018, the average FICO credit score was 704 which is slightly up from 700 the year prior. The average VantageScore was 680 which is up from 675 the year prior. The factors that are taken into account are the same among the two ratings, but the weight they are given varies slightly.

5 Components Of The Credit Score Calculation

- Payment history

- Amount of debt owed

- Length of credit history

- Mix of credit accounts

- New credit inquiries

The average credit score required for activities such as buying a car, renting an apartment, and getting auto insurance can vary. According to Bankrate, in 2018, people who borrowed money for a new car had an average credit score of 718 while used car shoppers had an average score of 659. For renting an apartment, the minimum credit score is between 600-620. Finally, the average car insurance premium for those with excellent credit is $1,130 compared to $2,411 for those with poor credit - that's more than double.

Average Credit Score by Age, Geography, and Income

The average credit score is not consistent across age groups, geography, and income levels. FICO reports that the average credit score rose 5 points across all age groups but there was a significant difference between the youngest group (18-29) and the oldest (60+). The average credit score for the youngest age group was 659 while the average for the 60+ age group was 747. The discrepancy is even greater for the VantageScore by age group with an average score of 659 for ages 18-29 and an average score of 747 for ages 60+.

In addition to age, there are trends among the location (specifically the state in which a consumer resides) and the average credit score. Minnesota ranks at the top with the highest average credit score of 713 and Mississippi sits at the bottom with a 652 average score. Possible reasons for the geographical differences are local economic factors such as unemployment and income levels by state.

States with the Highest Average VantageScores:

- Minnesota — 713

- South Dakota — 707

- Vermont — 705

- New Hampshire — 704

- Massachusetts — 703

States with the Lowest Average VantageScores:

- Mississippi — 652

- Louisiana — 653

- Nevada — 659

- Georgia — 659

- Texas — 659

While income doesn't directly factor into the credit score formula, it will be considered when you apply for a car loan or mortgage. There is a correlation between consumer income level and average credit score. According to WalletHub, these are the average credit scores by income in 2017:

Annual Income and Average Credit Score

$30,000 or less — 590

$30,001-$49,999 — 643

$50,000-$74,999 — 737

Why Does a Good Credit Score Matter?

A good credit score means getting a loan for a new or used vehicle will be fairly simple and your interest rate will likely be lower, making monthly payments more affordable. Other events where your credit score will be examined include: getting a mortgage to buy a house, leasing an apartment and even buying car insurance. When it comes to car shopping, borrowers with scores in the "very good" or "excellent" categories usually qualify for manufacturer financing offers with very low-interest rates.

image: Experian

According to Experian, about 67% of consumers fall into the good, very good or exceptional categories. Those in the very poor category (300-579) tend to have a hard time getting approved for credit. Those in the fair range (580-669) may have an easier time getting approved but their interest rates will usually not be favorable. Those with a good credit score (670-739) will be approved easily with favorable rates, and those in the very good and exceptional categories (740-850) will get the most competitive rates.

How to Boost your Credit

If your score is sitting smack dab in the middle of the poor or fair range, it doesn't mean you have to struggle with loan approval or sky-high interest rates forever. There are 5 steps you can take to improve your credit score over time. Although these aren't quick fixes, taking these actions as soon as possible will pay off when you achieve a good credit rating.

Tip 1: Get rid of credit card balances

Tip 2: Always pay bills on time

Tip 3: Pay more than the minimum

Tip 4: Use credit regularly and pay it off

Tip 5: Check for errors on your credit report

Not everyone can wait for their credit to improve to buy a car. If that describes you, make sure you shop around for auto financing before going to the dealership. Firstly, you don't want to be surprised by an auto loan rejection after you've picked out your vehicle and negotiated the price. Secondly, shopping for the best interest rates and getting pre-approved for a car loan can get you a significantly lower interest rate.