Auto loan debt has been skyrocketing, and subprime borrowers are taking a bigger hit than most. Even before COVID-19, auto loan debt was on the rise in the U.S., with $1.3 trillion owed in car loans. The cause of the increasing auto debt can be attributed to low interest rates, rising vehicle prices, and subprime lending practices. Now with a pandemic and the economic slump added to the mix, the climbing auto debt in the U.S. will have implications for the economy, car owners, and specifically those with compromised credit.

Auto Debt is Rising Faster than other Categories

Auto loans account for one of the largest categories of debt with 116 million active car loan accounts, according to Brookings, a non-profit public policy organization. The number of car loans significantly outnumbers the number of mortgages that currently sits at 81 million.

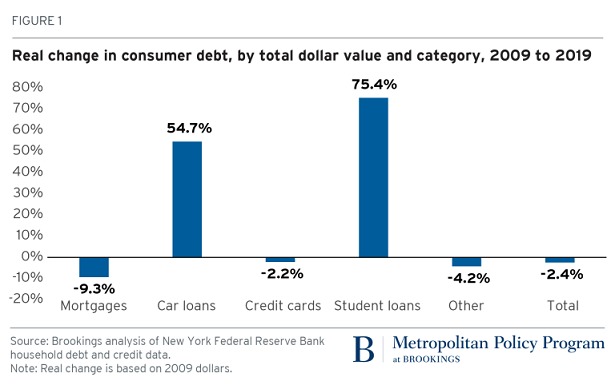

The $1.3 trillion in auto debt is a startling increase of 55% since 2009, and outpaces every other type of debt besides student loans. While high-income car owners typically take on less debt to purchase a vehicle, lower-income car owners, many of whom have compromised credit, are struggling to cover high transportation costs amid the pandemic.

Subprime Borrowers are the Hardest Hit

Borrowers with subprime credit took on more car loans than those with good credit in the last decade. Car loans for shoppers with credit scores below 620 catapulted from $11 billion in 2009 to nearly $26 billion 10 years later (a 127% increase) and many of these loans are still being paid. Unfortunately, lower-income borrowers have also been hit the hardest by the COVID-19 pandemic with layoffs or essential work that requires dependence on a vehicle. This group is especially vulnerable to defaulting or deferring loan payments due to the high interest, long-term car loans that are typically offered to them.

Auto Loan Financial Hardships

According to CNBC, auto loans and personal loans account for the majority of financial hardship programs out of all debt categories. As of June, 7% of auto loans are reported to be in a hardship program which includes a deferred payment, forbearance program, frozen account or frozen past due payment. This is significantly higher than the average 4.6% of overall debt accounts including auto, bankcard, mortgages, and personal loans. Given the rising rates of auto debt, it comes as no surprise that it is the category with the most financial struggles during COVID-19.

Thanks to lender relief programs and government actions including unemployment benefits and stimulus checks, auto loan defaults have remained low, but there is a risk this can change. If the government assistance runs out and borrowers remain out of work or on reduced incomes for the long-term, auto loan defaults will rise substantially.

Implications

The implications of rising auto debt, financial hardship programs, and the COVID-19 pandemic are a concern for the economy as a whole as well as lower-income, subprime borrowers who are most at risk. Brookings predicts that the burden of transportation costs and auto debt will have a domino effect on the economy and create a roadblock for it bouncing back from the pandemic: "Stretched budgets, missed payments, and less consumption overall—could create a drag on a wider economic recovery."

Another likely consequence is that buyers with compromised credit may find it harder to get approved for an auto loan in the coming months. With the end of the pandemic nowhere in sight, and the volatile credit conditions, auto lenders will be warier about their lending practices. According to Cox Automotive's Jonathan Smoke, "it will be harder and more expensive than it has been for probably all credit tiers, but it will be especially hard for the 20% of the market that is subprime."